Home

Empowering the Next Generation of Finance

nst is a fintech platform offering family banking for modern households and payment service solutions for businesses.

Bridging Generations with Smarter Financial Tools

Who We Are: nst is a forward-thinking fintech venture based in the MENA region. Our platform delivers intuitive family banking solutions and enterprise-grade payment tools through strategic partnerships. By combining innovation with accessibility, we aim to simplify the way families and businesses interact with finance.

Our Vision

To empower families and businesses with accessible, intuitive, and future-ready financial tools.

Our Mission

To simplify digital finance across generations and industries by combining powerful technology with inclusive design and reliable partnerships.

Family Banking

We’re building an app designed to empower families with smarter, safer, and more educational money tools. Launching soon, nst Family Banking will transform how parents and kids manage money together.

- Digital wallets for parents and children

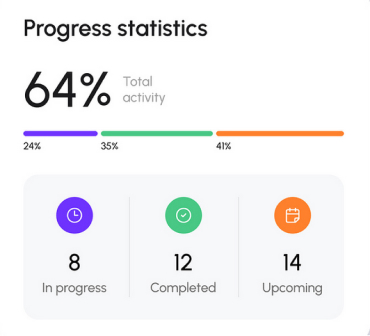

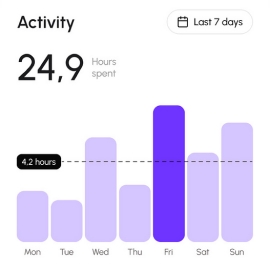

- Parental controls and spending insights

- Task-based cash rewards and gamified savings

- Scheduled allowances and financial education tools

- Monthly statements and real-time transaction tracking

nst Payment Gateway

nst offers secure and efficient payment gateway services through white-labeled partnerships with licensed providers. Our B2B solution is ideal for e-commerce platforms and digital-first businesses.

Fast and reliable online payments

Seamless e-commerce integration

Multi-currency and local payment methods

Tokenization and fraud protection

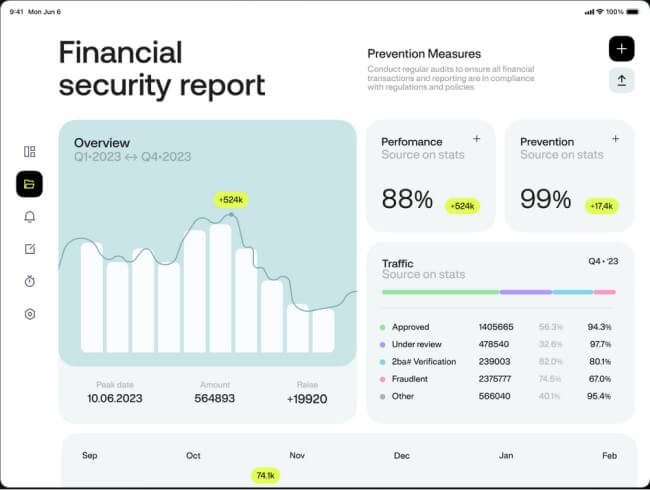

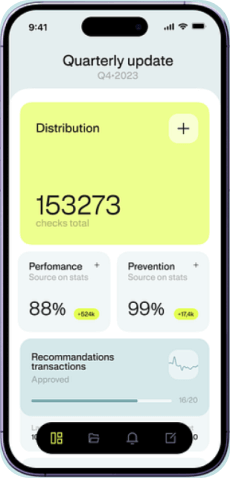

Real-time analytics and transaction reporting

nst Payment Orchestrator

Our payment orchestration solution enables businesses to manage multiple payment service providers through a unified interface. Provided via licensed partners, this service is ideal for companies looking to optimize transaction routing and reduce costs.

Smart routing across PSPs

Failover handling and redundancy

Automated reconciliation

Unified dashboard and insights

Scalable API integrations

Empowering Families and Businesses Across the Financial Journey

Families

Parents and children seeking secure, educational, and rewarding financial tools that build healthy money habits.

Startups & Merchants

Digital-first businesses needing fast, secure, and customizable gateway solutions to support growth.

Enterprises

Organizations looking to optimize and streamline payment workflows with orchestration tools.

Why Choose nst

We’re not just building financial tools — we’re creating a secure, scalable, and future-proof ecosystem tailored for families and businesses in the MENA region and beyond.

Trusted Foundations

Flexible architecture that adapts to your needs — whether you’re a parent, a startup, or a global enterprise.

Modular Design

Flexible architecture that adapts to your needs — whether you’re a parent, a startup, or a global enterprise.

Enterprise Security

End-to-end encryption, fraud protection, and compliance with the highest international standards.

Regional Scalability

Designed for the unique needs of the MENA market, with infrastructure ready for international expansion.

1. What services does your fintech agency provide?

2. How do you ensure the security of financial data?

Our fintech software uses advanced encryption protocols, multi-factor systems authentication, and regular security updates to protect your data from unauthorized access and cyber threats prioritize.

3. What is your experience in developing fintech applications?

4. How do you approach a new fintech project?

We start by understanding your business goals, conduct market research, create a customized strategy, and develop a compliant, high-performing solution.